23rd Sep 2025

Industrial REITs are steady, yields are juicy, and rates are falling – so is now the moment to move?

Hosted by Michelle Martin, this episode breaks down why industrial S-REITs have held firm with strong occupancy and rental reversions.

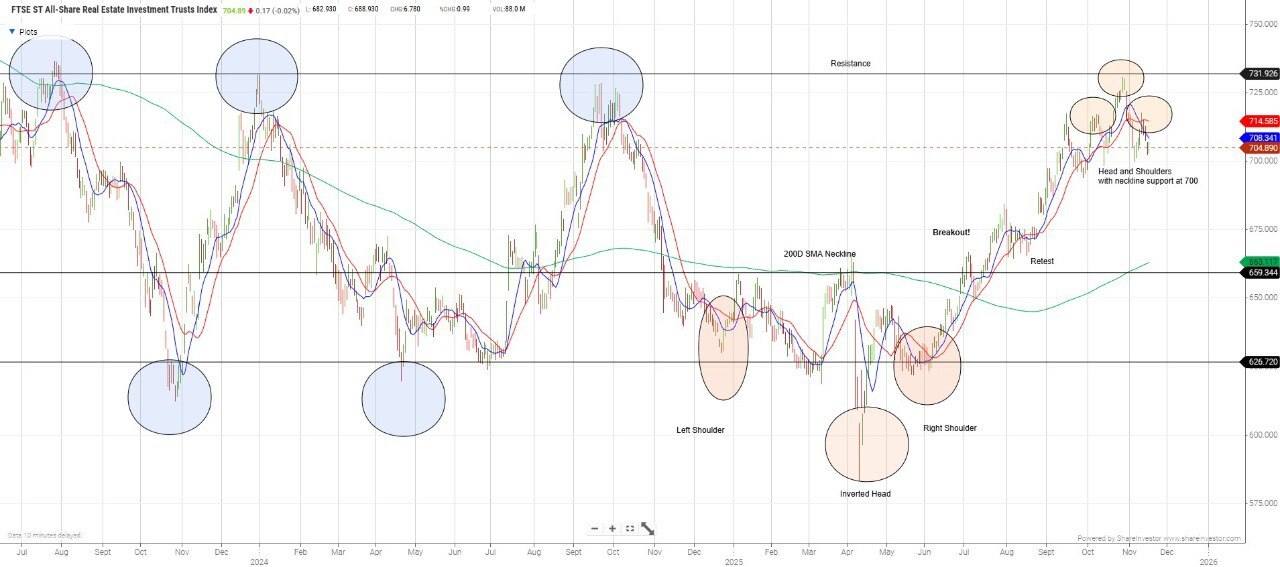

We explore how the wider S-REIT universe has staged a 2025 rebound on easing debt costs and a friendlier rate outlook.

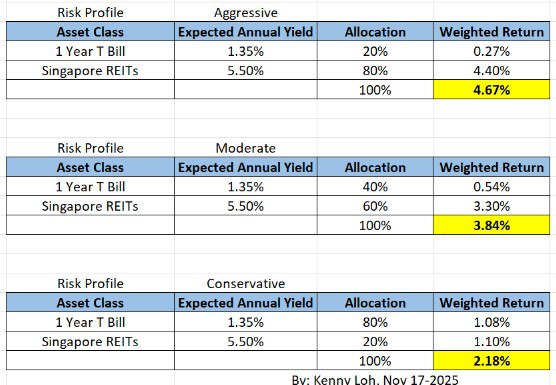

With T-bills slipping near 1.37 – 1.4%, Kenny Loh weighs in on whether REIT yields of 5 – 6% still offer real value.

Is this rally just a “rates are going down” trade – or the early innings of a broader re-rating?

Kenny also shares clear strategies for conservative investors navigating income, risk and timing.

Note: The above analysis are my own personal views and are NOT buy or sell recommendations. Investors who would like to leverage my extensive research and years of Singapore REIT investing experience can approach me separately for a REIT Portfolio Consultation.

Listen to his previous market outlook interviews here:

2025

2024

2023

2022

2021

2020

Kenny Loh is an Associate Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair.

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement