Did you know that the global fintech market is growing at a staggering pace? By 2025, it’s expected to cross $305 billion in value as digital-first banking, investment platforms, and payment solutions dominate consumer behavior. Yet, behind every sleek fintech app lies a question that startup founders, investors, and product managers ask first: How much does fintech app development really cost?

The truth is, there’s no single figure to answer this question. The cost varies based on your target region, tech stack, app type, compliance needs, and even how you plan your rollouts. More importantly, building a fintech app is not just about cost; it’s about making the right investments to ensure security, scalability, and ROI.

This blog breaks down the real cost drivers, hidden expenses, must-have features, budgeting strategies, and ROI insights. By going through this guide, you can plan your fintech app development journey wisely. So, stay tuned till the end for some useful insights :

Why Understanding Fintech App Costs Isn’t Optional

For startups and enterprises alike, miscalculating mobile app development costs leads to two outcomes:

- Underfunded launches that compromise on features, security, or scalability.

- Over-engineered builds that waste resources and delay time-to-market.

Given the high-risk nature of fintech, budgeting wisely is not a luxury but a survival strategy. Therefore, it’s advisable to avail professional fintech application development services to plan your project budget.

Key Factors Driving Fintech App Development Cost

Now, let’s start by unpacking the biggest cost drivers.

| Cost Factor | Impact on Budget |

| App Type (banking, lending, payments, wealth, insurance) | Complex apps like banking or lending cost more than basic wallets. |

| Platform (iOS, Android, Web) | Native apps cost more than cross-platform solutions. |

| Features & Integrations | AI chatbots, analytics, and advanced security add to costs. |

| Compliance & Licensing | SOC 2, PCI DSS, and GDPR compliance require audits, legal support, and certifications. |

| Infrastructure & Hosting | Cloud vs on-premise setups affect scaling and cost efficiency. |

| Design & UX | Humanized UI/UX for financial trust requires deeper investment. |

| Maintenance & Upgrades | Ongoing updates, security patches, and feature rollouts are often underestimated. |

Note: Several factors, such as platform choice, app complexity, security & compliance, development team location & expertise, directly affect the fintech app development cost. Choosing between iOS app development, Android, or both directly impacts costs. Cross-platform solutions may reduce expenses but could compromise performance. Apart from this, basic apps are generally less expensive, while those requiring advanced features, such as AI integration or real-time data processing, tend to increase costs. Moreover, implementing cybersecurity in fintech app development and adhering to regulations (e.g., GDPR, PCI-DSS) adds to development expenses.

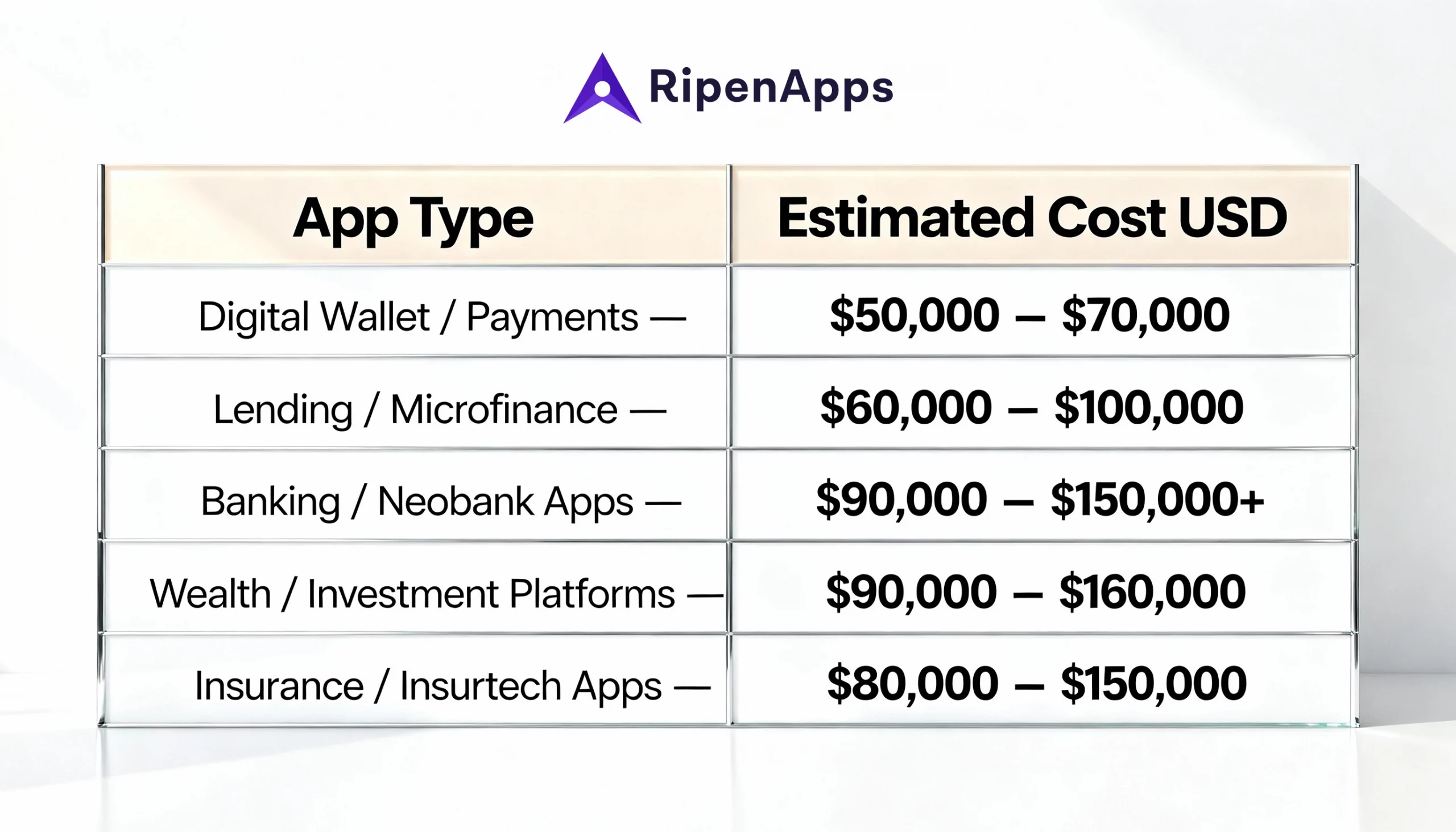

Fintech App Costs: App Type and Budget Range

The type of fintech app you choose, whether it’s a digital wallet, trading platform, or lending app, directly impacts your project budget. Each app type has different complexity levels, security needs, and feature demands, which shape the overall development cost.

Note: On average, building a basic MVP app costs around $40K – $80K; a mid-complexity app can cost around $80K – $120K. However, if you are looking to build an enterprise-grade fintech app development solution with advanced features, it could cost you around $120K – $250K+. These are the average costs to build a fintech app, influenced by geography, features, and compliance requirements. However, to know the accurate cost estimation, you must reach out to a top-notch Fintech app development company. They will provide you with an accurate estimation.

Read Also: Fintech Vs. TechFin: Predicting The Future of Finance and Banking

Must-Have Features To Build a Fintech App

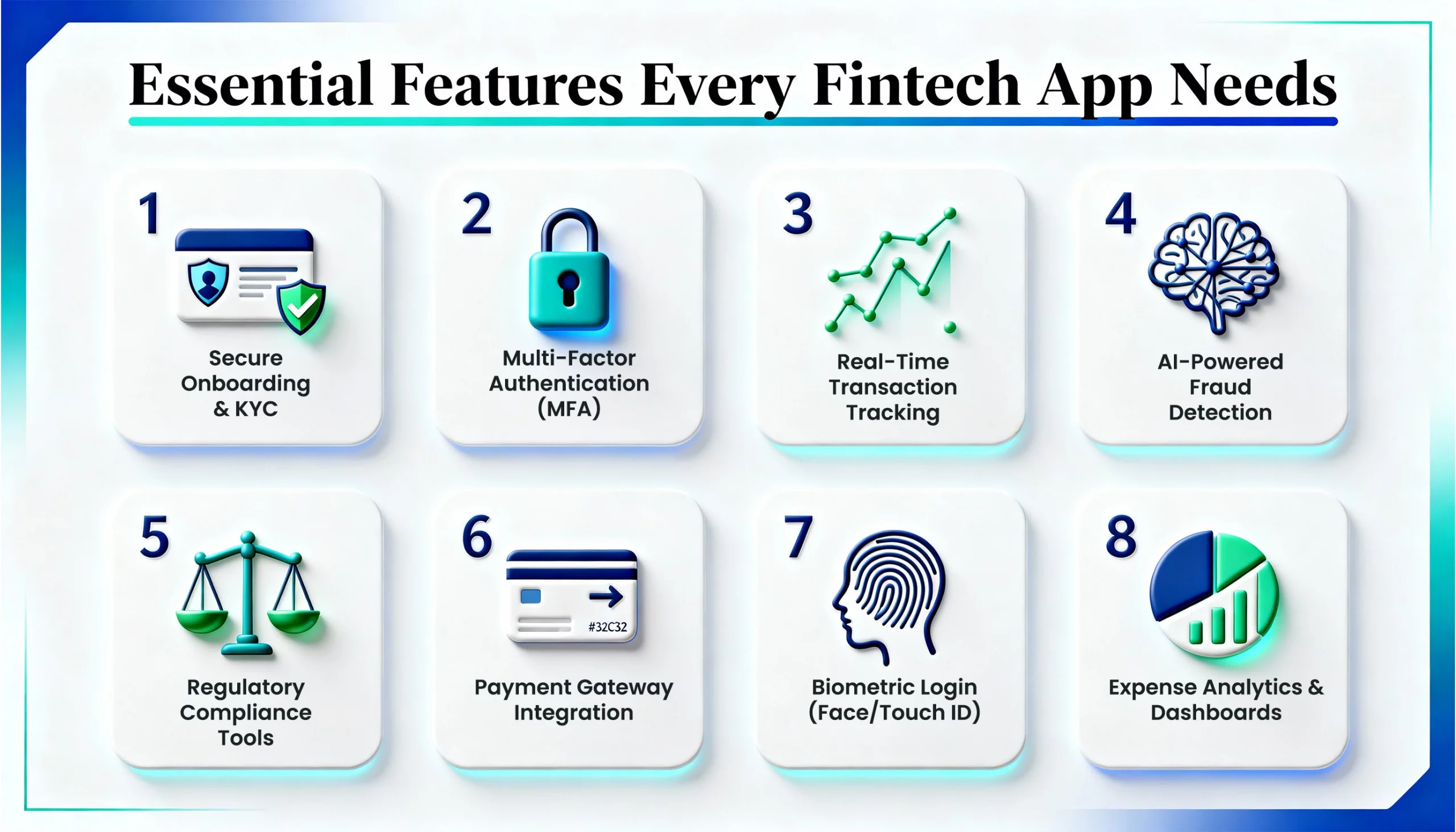

In fintech, user trust is everything. A single missing feature can make customers switch to another app in seconds. To build a product that stands out, you need security, speed, and simplicity at the core. Skipping essential features in fintech apps often leads to failed launches. Here are the non-negotiable features every fintech app should include :

In fintech, user trust is everything. A single missing feature can make customers switch to another app in seconds. To build a product that stands out, you need security, speed, and simplicity at the core. Skipping essential features in fintech apps often leads to failed launches. Here are the non-negotiable features every fintech app should include :

1. Smooth & Secure Onboarding with KYC

First impressions matter a lot. A smooth yet secure onboarding flow built through custom app development builds trust while meeting compliance standards. Integrating KYC (Know Your Customer) ensures safe account creation, reduces fraud risks, and keeps regulators satisfied.

2. Multi-Factor Authentication (MFA)

Passwords alone aren’t enough anymore. Adding layers like OTP, email confirmation, or app-based codes boosts security. MFA reassures users that their financial data is safe every time they log in. You can opt for top-notch fintech app development services to seamlessly integrate advanced security features.

3. Real-Time Transaction Updates

Users want transparency in every move of their money. Real-time updates on payments, withdrawals, or transfers provide clarity and reduce disputes. It also enhances user confidence by minimizing hidden delays.

4. AI-Powered Fraud Detection

Fraud can drain both businesses and customers in seconds. AI-driven tools spot unusual activity instantly and flag it before damage occurs. This proactive defense gives startups a major trust advantage.

Read Also :Leveraging AI For Fraud Detection And Prevention In FinTech Apps

5. Regulatory Compliance Tools

Staying compliant isn’t optional in the fintech industry, but it’s mandatory. Built-in compliance checks (like AML or GDPR) save businesses from penalties and keep operations running smoothly. Automating these processes reduces manual headaches. Therefore, you must invest in top-notch mobile app development services to build a scalable fintech app while staying fully compliant and future-ready.

6. Payment Gateway Integration

A seamless payment gateway is the heart of any fintech app. Users expect quick, secure transactions across cards, wallets, and UPI. The smoother the payment flow, the better the retention.

7. Biometric Login (Face/Touch ID)

Convenience meets safety with biometric access. Face ID and Touch ID not only improve app security but also make login frictionless. Users feel protected without dealing with complex passwords, which is why the top fintech app development companies prioritize integrating such features into their apps.

8. Expense Analytics & Dashboards

Beyond transactions, users want insights. Smart dashboards and analytics help them track spending, set budgets, and improve financial habits. Partnering with a skilled UI UX design agency ensures these dashboards are not only functional but also intuitive, making your app more valuable than your competitors.

Read Also: An Ultimate Guide to Fintech Software Development: Key Features, Benefits, And Cost

Hidden Costs Founders Often Miss

Many fintech founders focus only on development, ignoring “invisible” costs that appear later:

| Hidden Cost | Why It Matters |

| Licensing Fees | Banking APIs, payment processors, and others aren’t free. |

| Security Certifications | PCI DSS, SOC 2, and ISO audits add compliance expenses. |

| Infrastructure Scaling | Cloud auto-scaling costs grow as the user base increases. |

| Maintenance & Monitoring | Annual costs often reach 15–20% of development spend. |

| Feature Upgrades | Adding new tools like crypto wallets or robo-advisors increases the budget post-launch. |

Smart Budgeting for Fintech App Development: Where Startups Save the Most

Building a fintech app doesn’t always have to burn a hole in your pocket. Along with fintech app pricing models, founders must also be aware of the following budget-optimizing ways :

1. Start With an MVP

Firstly, you need to validate your idea without overspending. Add advanced features once traction builds. It’s crucial to take feedback regarding your app and then develop a full-fledged, successful app. Starting with an MVP app development allows you to test the market, attract early users, and make informed decisions for scaling.

2. Use Reusable Modules

Don’t reinvent. Ready-made KYC, payment gateways, and fraud-detection APIs cut costs to a great extent. These modules are tried-and-tested. Thus, it reduces development time and minimizes errors while maintaining security standards.

3. Prioritize Compliance Early

Industry compliance later doubles the overall costs. Integrating regulatory and legal requirements from day one avoids fines, ensures user trust, and keeps your app launch timeline smooth.

4. Leverage Cloud Infrastructure

AWS, Azure, and GCP offer scalability without upfront server costs. Cloud services also provide high availability, automated backups, and easy expansion as your user base grows. Therefore, it eliminates the need for heavy IT investments.

5. Adopt Agile Development

Iterative builds reduce waste, speed up delivery, and lower rework costs. Agile methods allow your team to quickly respond to user feedback, fix bugs on the go, and ensure the final product aligns closely with market needs.

ROI Insights: Measuring Success Beyond Launch

Many startups think ROI comes only from user acquisition. In fintech, ROI is multi-dimensional. Here is a tabular presentation for the same.

| ROI Factor | How It Works |

| Customer Trust | Secure apps with transparent UX bring long-term loyalty. |

| User Retention | Features like instant support and personalized dashboards keep users active. |

| Operational Efficiency | AI and automation reduce manual effort and costs. |

| Regulatory Readiness | Staying compliant saves millions in fines. |

| Revenue Models | Subscriptions, transaction fees, commissions, and premium features. |

Budget Forecast: What Should You Plan for?

Here’s a simplified forecast to help you visualize fintech development costs:

| Stage | Estimated Budget (USD) |

| MVP Development | $50,000 – $80,000 |

| Full-Feature App | $100,000 – $200,000+ |

| Annual Maintenance | 15–20% of the development cost |

| Compliance & Licensing | $20,000 – $100,000 annually |

Wrapping Up

For every entrepreneur, understanding the true cost of fintech app development is the first step toward smarter investment. From choosing the right platform and app type to integrating essential features and meeting compliance standards, every decision impacts your budget and app success. Several hidden costs like licensing, security certifications, and maintenance can add up, but planning helps avoid surprises.

You can start with an MVP, leverage reusable modules, prioritize compliance early, and use cloud infrastructure to scale efficiently. By balancing cost, quality, and compliance, fintech startups and enterprises can deliver secure, user-centric apps while optimizing ROI and staying ahead of their competitors. So, remember, fintech app development isn’t about finding the cheapest solution, but it’s about making smart investments that ensure security, compliance, scalability, and ROI in the long run.

FAQs

Q1: How much does fintech app development cost in 2025?

The cost of building a fintech app usually ranges between $40,000 $150,000+. The overall cost depends on several factors such as features, compliance needs, and scalability goals. MVPs cost less, while full-scale apps with advanced features are higher.

Q2: Which essential features increase fintech app development cost the most?

Security features like multi-factor authentication, fraud detection with AI, and regulatory compliance tools add significant costs but are non-negotiable for user trust and legal safety.

Q3: How can startups reduce the cost of fintech app development?

Startups can save money by first launching an MVP, using reusable components, leveraging cloud infrastructure, and working with an experienced fintech mobile app development company that avoids costly mistakes.

Q4: How long does it take to develop a fintech app?

On average, fintech apps take around 8–10 months to develop, depending on complexity. MVPs can be launched faster, while full-scale apps with advanced features and compliance take longer.

Q5: What’s the ROI of investing in fintech app development?

A well-built fintech app delivers ROI through higher user retention, transaction fees, premium services, and customer trust. The upfront cost pays off by building long-term revenue streams.